Screentrade makes a comeback

Devitt Insurance Services has gone live with its Screentrade car insurance offering, as the latest development in its relaunch of the brand. The product is now live and quoting on the Confused panel, with other aggregators to follow.

Devitt has worked with CDL to create powerful online platforms for the suite of Screentrade insurance lines, which include Private Car, Motorcycle and Goods Vehicle.

William Hughes, Managing Director of Devitt, said: "Screentrade launched as the UK's first online insurance broker and quickly made its name as a powerful online brand. When Devitt acquired Screentrade from Lloyds TSB we knew that we needed to capitalise on the strong Screentrade brand recognition. We have worked with CDL to again deliver an online customer journey that's ahead of the competition."

CDL has developed mobile-optimised websites for the Screentrade brand, featuring responsive liquid layouts, designed to display equally well on the UK's most popular tablet and smartphone devices. The websites also promote a faster quotation process, with features including vehicle lookup data to automatically populate vehicle details and intelligent, dynamic question sets.

Nigel Phillips, Commercial Director of CDL, said: "We have seen a phenomenal rate of growth in the number of customers using smartphones or tablet devices to complete insurance quotes on websites powered by CDL. By working with Devitt to cater for this shift towards mobile, we're helping them position Screentrade to meet the needs of modern digital consumers."

Gladiator migrates to CDL Strata

Leading UK van insurance broker, Gladiator, part of the Admiral Insurance Group, has migrated its entire motor and SME portfolio to the CDL Strata software platform. The large-scale policy migration went live mid-September.

In addition to an improved policy administration system for its employees, the Strata migration gives Gladiator's customers access to comprehensive self-service facilities and electronic documentation online, through CDL's web and mobile portals.

Mark Gabriel, Managing Director of Gladiator, said: "Gladiator has grown into a market leader for Commercial Vehicle Insurance. This upgrade to take advantage of the comprehensive self-service experience offered by Strata provides the scalability and versatility that we need to meet the growing needs of our customers."

Spotlight on: The Connected Home

After significant investment and developments by tech giants like Apple and Google in 2014, the concept of the Connected Home, in which everyday utilities are connected to the internet and can be monitored and controlled remotely, is becoming a very real proposition. CDL has launched a research and development programme to examine the possibilities for insurance products in this space, with a focus on extending the easy integration and automation of CDL's telematics hub into the field of home insurance.

Technology commentators have called 2014 the year of the Internet of Things, a broad way of referring to the fact that more and more household objects are being connected to the Internet. In a world full of smart phones, smart watches and connected cars, the next logical step is for these and many more products to be joined up in systems that allow consumers to monitor and regulate an array of devices from a single platform.

Personalising home insurance

Early entries to the Connected Home market include smart thermostats, smoke and flood detectors, heating systems, burglar alarms, locks and lighting. The aspect of the Connected Home that is most relevant to the insurance industry is the concept that these devices can be used to build up a picture of what goes on in a home and how that relates to insurance risks on an individual level, rather than generalised risk based on postcode and demographic profiling.

Systems such as Apple's HomeKit, Google's Nest Labs and Samsung's SmartThings are turning the concept of a Connected Home into reality. The quantity of granular personal data being generated by Connected Home systems already is vast, but insurers hoping to capitalise on this new phenomenon need first to convince consumers of the benefits of installing the technology

Incentivising uptake

Offering consumers an appealing incentive to adopt the new technology might be the most important factor in determining the rate of growth for the Connected Home. There are parallels to the early days of telematics, but ostensibly there are less obvious savings to offer consumers in the property market than in motor insurance.

The concept behind telematics devices was that motorists could demonstrate their safe driving in a measurable way and be offered potentially large savings on their premiums by insurers. Premiums in the household market work slightly differently, with less correlation between usage and overall risk level, which means that less incentive can be offered through price discounts.

Risk prevention

The key benefits that the Connected Home offers to consumers lie in risk prevention, offering peace of mind and the increased convenience. If it can be proven that Connected Home devices reduce the risk of homeowners being burgled, or that individualised notifications linked to water sensors can significantly reduce the flood damage caused by burst pipes, for example, then this will provide a strong incentive for the adoption of these devices.

Minimising claims

Insurers, as well as consumers, could see great benefits from the Connected Home. Loss ratios in the home insurance sector could be improved by using Connected Home devices to minimise the number of claims occurring and being able to verify which claims are genuine.

In order to make the Connected Home a viable proposition for consumers and insurers alike, the array of Connected Home devices will need to link seamlessly to a policy administration system, and consumers will need intuitive portals to help them understand the data that they generate and how it affects their insurance premiums.

The Connected Home offers significant growth opportunities for insurance retailers, which is why CDL is committing resources to explore software that would allow our partners to be the first to benefit. To find out more about CDL's research and development in this field, please contact luke.anyon@cdl.co.uk for more information.

Viewpoint:

Brendan Devine on the textbook launch of Sure Thing!

Earlier this year, new insurance broker Sure Thing! entered the market. A fresh and unique brand, it enjoyed the perfect start to its trading life, smashing sales target by 300% in its first quarter. Its Chief Executive Officer, Brendan Devine, formerly of Kwik Fit Insurance fame, gives his perspective on the launch and his plans for the for the brand.

Sure Thing! is a fairly unusual name for an insurance broker. How did you arrive at it?

Great service and experience is at the heart of what we're about. We wanted our customers to be clear that we're very straightforward to deal with and that nothing is too much of a problem. "Sure Thing!" suited our vision perfectly and the brand really developed from there. The response to the brand from consumer testing was very positive and, since launch, we've had great feedback on our customer experience.

How have things gone so far?

We enjoyed an incredibly smooth launch. We went live on 1 April, exactly as planned, with 11 insurers and links to four aggregators live within the first week. As a result, sales have been consistently above our forecasts, making for a great start. Also, most encouraging is our customers have responded really well to the brand and customer journey. We are seeing 80% of our customers are buying online and results from a survey showing 91% would recommend us.

What have the critical success factors been?

We were well prepared for the go-live. Everything had been tested and the technology all worked as it should do. We were well supported by all our partners, including CDL, and we have a great deal of industry experience amongst our senior team, which meant we had good connections to draw upon. We've also been able to recruit great people in our contact centre, which currently employs around 60 people.

Why did you appoint CDL as your software partner?

We prepared a brief and went through a tender process with the key software houses to select our partner of choice. Historically, the insurance sector has been relatively antiquated, and there just isn't room for that in today's digital landscape. CDL were chosen as we felt they were a like-minded business with a scalable solution to support our growth plans. We were impressed with Strata, the responsive nature of the journey as well as the online self-service portal; reflected where we wanted to go with our brand.

Have they delivered?

In practice, it's delivered exactly what we hoped. Our website is performing well and as optimised for mobile gives a good digital experience. As a result we're finding that 80% of our customers are buying online and the vast majority of those are registering for the self-service portal. That's translated into 25% of mid-term adjustments made online, a figure that is growing steadily. It sets us up well to operate efficiently and, overall, we've had great support from CDL, which has contributed to the positive start we've enjoyed.

Any plans for the future?

Certainly we hope to continue the growth we've seen to date, particularly as we continue to add insurers to our panel and make improvements to our customer journey through more technological innovation. We also plan to launch new products over the next 18 months, and we will be continuing with our recruitment drive to support these plans going forwards. Our aim is that 2015 will be an even more exciting year for Sure Thing!

Aviva - Giving your business a boost

Scheme Name:

Your House

Scheme Code:

ON and OD

Company Code:

NU

Aviva has announced key enhancements being made to its Your House product.

From 6 August 2014 Aviva increased its buildings sum insured to £1m for all new business. This will be the new standard product limit, ensuring that customers get the cover they need. Additionally, Aviva has introduced the ability to write buildings only cover.

Aviva has also created a new innovative rating solution, which will make its rating more competitive than ever before.

These changes became effective for any renewal business from 6 September 2014.

Simon Warsop, Personal Lines Chief Underwriting Officer at Aviva, said of the changes: "In a challenging market, we know it can be hard to grow your business without compromising on the cover you offer to customers - but consolidating business with Aviva can help you do just that."

What is meant by a 'consolidation'?

Grouping some or all of your household insurance business together with Aviva, rather than spreading it across a number of carriers.

Benefits:

Aviva recognises that you need quick, hassle-free ways to help take your business to new heights. With consolidations, you can benefit from:

- More time - just one set of paperwork to deal with, no more ringing round multiple carriers

- Increased efficiency - only one process to work with

- Peace of mind - you know you can trust Aviva to provide quality products and first-class service

Consolidating can also help give you a financial boost, reducing your operating costs and offering you a competitive edge to help increase revenue.

If you have any questions about these changes or would like to talk through any consolidation opportunities, please just get in touch with your Aviva business development manager.

ABC Car - Temporary Adjustments just got easier!

LV=Broker wants to make it easier for the CDL community to do business with them and is always reviewing how it can improve processes to help look after customers.

The next time you need to make a temporary adjustment for an ABC Car customer you'll be able to do it through CDL!

From now on, if you need to process a temporary additional driver or vehicle, you can simply process the changes through the CDL temporary amendment function. All you need to do is make sure you implement your latest CDL updates to get access.

Benefits:

- Making temporary changes will be quicker

- Give customers an instant decision on cover

- Provide customers with updated documents straight from CDL

- Offer more flexibility, because changes can be made 24/7

Look out for more updates coming soon that will make it even easier to work with LV= Broker.

Please contact your Regional Account Manager with any queries.

60 Second Interview

Name: Ian Donaldson

Title: Managing Director of Autonet Insurance

How did you get into insurance?

By accident really, some friends of mine were working in an insurance call centre, I had given up on wanting to be a pro-football player so saw working with my mates as the next best thing to do for a while.

What you love about it?

The huge opportunities the industry can offer to everybody, from all walks of life with differing levels of education.

What you hate about it?

Sorry to say it but regulation is becoming a bit of a burden to the industry. Although I am all for treating customers fairly and transparency throughout the life of an insurance policy, the industry and clients are being bogged down unnecessarily.

Best professional achievement?

I would have to say Autonet and its growth, from two guys in a room dreaming of owning their own business to creating the largest van broker in the UK, building aggregator sites for the likes of Money Supermarket and creating work for 700 or more local people, it's been a journey I am extremely proud of.

Biggest challenge facing the sector?

The implementation of the regulation I have eluded to already. Ensuring the business not only continues to grow and offer career development for all of its staff, but that it does so whilst being totally compliant in every process it delivers.

Biggest opportunity?

New markets! I want to see Autonet push on in the SME world, linking all of its van clients into SME products. We will also continue to push private car and through 2015 we will see household get a re-vamp and see some big growth. Due to our commitment to this growth and new markets, Autonet will offer many opportunities to its staff in the form of career progression.

Which gadget could you not live without?

My very old and unfashionable Blackberry phone, it's linked into work and I can see everything that is going on 24/7, probably not what my fellow Directors like but I love it!

Football team?

The one and only Liverpool FC - YNWA!

Desert island discs?

Oh dear - my music taste is pretty shocking, here goes:

- Have to have some of the King himself - Elvis

- A bit of old rock, so probably Dire Straits

- Finally - a whole medley of 80's music

There was a worrying amount of Taylor Swift in the list that I've chosen to blame on my daughter ...

Biggest vice?

Always wanting to be involved in literally everything that goes on within Autonet as a business, I find it extremely difficult to not have my input into something.

How do you unwind at weekends?

If you ask my wife that question she would probably say I never do, now we are open some Sundays I treat the weekends pretty much like weekdays, however, my two sons and their football keep me busy and just simple family time is the best way to unwind for me - perhaps a large glass of decent red wine or a few pints of Guinness is a good help too!

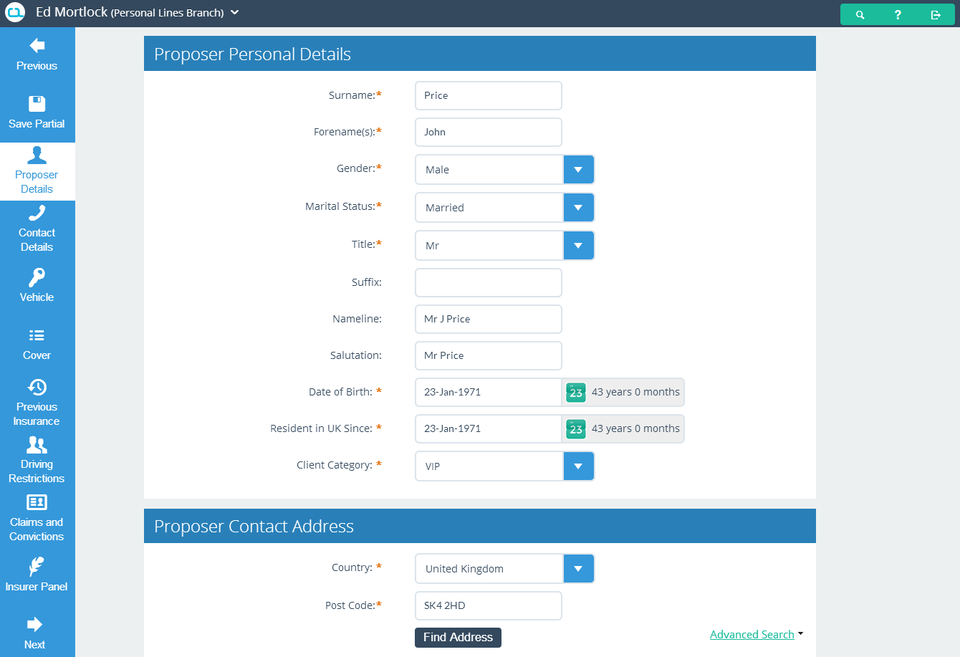

Software Update: New Strata interface goes live

As reported earlier this year, CDL has placed significant investment in re-engineering the Strata user interface (UI) to create an elegant, streamlined solution that stands up to best of breed design principles. The soft launch of the new Strata UI took place in June 2014, when Ageas Retail ran the first pilot in a live environment; it was greeted with resoundingly positive feedback from contact centre advisors.

Flat design has been made ubiquitous through consumer launches, from Windows 8 to iOS 7 and has prompted the revamp of countless apps and websites, from Google Now to Skype.

It was in this context that CDL began work to ensure that the Strata interface remained as modern and intuitive - and flat - as those which have entered the mainstream for most people using desktop or mobile devices today.

Reduced training time

The imperatives for the move to a more minimalist interface have been to engineer a streamlined process that increases operational efficiency and can be mastered quickly by contact centre advisors to reduce training time. Where possible, text has been replaced with icons, and a flat, tiled layout has been introduced to provide a cleaner and more intuitive Strata UI.

Paul Newman, IT Director for Ageas Retail, explains that the simplified process was very much why the company was keen to get involved early: "One of our main drivers was to reduce training time and close the gap between the experience of consumers buying online, with no training at all, and that of our contact centre advisers, who may receive up to six weeks of software training."

The initial pilot at Ageas Retail saw half a dozen agents switch to the new Strata UI with just half a day of induction in advance. "It went really well," continues Paul. "The test group had minimal training and were able to find their way around the system easily. The feedback was very positive so we were quickly able to open up the pilot to a larger group of 18 agents.

Consumer feel

"We felt it was a very positive development from CDL to introduce a browser based interface that emulates the intuitive nature of the online experience. The new release has great usability and has a much fresher, more modern feel, that's already familiar from people's consumer experience of sites from Amazon or Google."

Indeed, the new Strata UI brings features of CDL powered consumer websites into the contact centre environment to reduce the call time, such as extended vehicle look-ups with vehicle valuations.

Retailers also have the option to tailor certain aspects of the data capture so that only questions they consider relevant to them or their panel of insurers appear on screen, using a new 'default' and 'hide' feature.

Another key feature is the consumer-centric nature of the new interface, with the enquiry screens redesigned so that all policyholder information is accessible within a single page.

Browser-based

From a deployment perspective, the browser-based nature of the solution makes it technically simpler to roll out Strata to new users.

"We're really excited about expanding the use of the new Strata UI further, and it fits with our aims to extend the solution to our partners and affinities," confirms Paul. "It will give quick access to a powerful and intuitive IT solution that's integrated with our other operations."

For more information on deploying the new Strata UI, please contact your relationship manager.